CPF (Central Provident Fund) is a mandatory social security savings scheme funded by contributions from employers and employees in Singapore. The CPF is a key pillar of Singapore’s social security system, and serves to meet Singaporean’s retirement, housing and healthcare needs. There is an average interest rate of 2.5% to 4% annually for those who have CPF account.

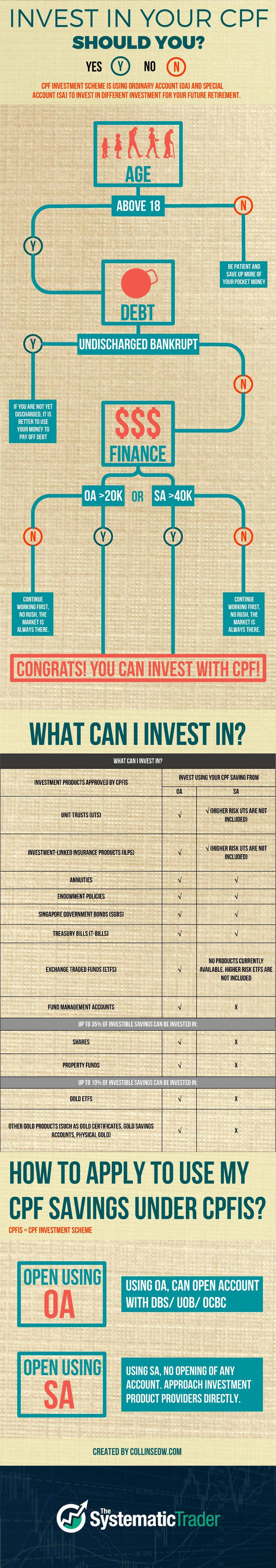

Besides using it for retirement. What sets the CPF different from the other countries’ social security is that Singaporeans can use it to invest in CPF approved investment instruments in Singapore. This CPF Investment infographic by The Systematic Trader will help you find out who are able to invest using their CPFs.

[Click here for full size version]