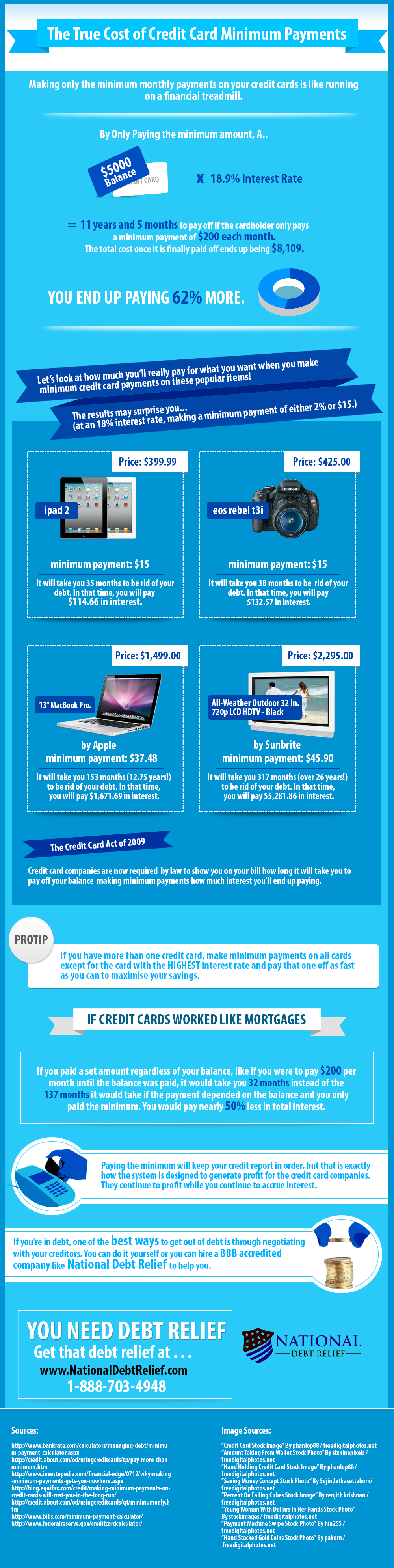

Meeting the minimum monthly payments of your credit cards is like running on a financial treadmill. Sure — we’re all guilty of it; whipping out the ole’ credit card whenever cash is tight.

In the long run, however, all those card swipes do count: if a cardholder made a minimum payment of $200 each month for a $5,000 credit card balance with an 18.9% interest rate, it would take 11 years and 5 months to finally pay off! When factoring in interest, the total credit card results come with a $8,109 price tag.

National Debt Relief explores this further in the following infographic.