Finance & Money Infographics

Factors Revealing the Future of Accounting Firms

As the technology is evolving with time, businesses are transforming their operations as well to meet the expectation of modern customers. We are quite mindful about the fact that accounting is the most crucial sector that needs to be handled precisely. Every business completely relies on its financial information to analyze the position of the company and make right business decisions.

Best Ways to Learn About Cryptocurrency Trading

The popularity and usage of cryptocurrencies have slowly been increasing, from existing alongside fiat money in paying for goods and services to acting as trading assets. If you are a trader who wants to get into the practice of crypto trading, then you need to be aware of all the possible sources of information you can tap to make you a better trader.

Why (and How) to Invest in the U.S. Land Market

Are you ready to buy land in the United States? There are many advantages to buying sooner rather than later. For example, there is a limited supply of land that is available for purchase. This means that land costs can increase as supply is limited. In the following...

Universal Basic Income

In a 2018 poll, nearly half of Americans supported the idea of a universal basic income program. What is universal basic income and what is it supposed to do? Learn all about the history and proposed future of this conceit courtesy of this infographic.

Beyond Bitcoin: How To Make Money With Blockchain

Blockchain is considered by many to be the most important invention since the Internet with its ability to enable entirely new business models, and transform the way we live, work, entertain ourselves, and relate to one another. You don’t have to be a Bitcoin millionaire to make money from blockchain technology. Learn how to leverage this emerging technology from this infographic.

What Your Myers-Briggs Personality Type Means for Your Wallet

Personality tests are used to give us insights on how we perceive the world, how we interact with others, and how we make decisions. Whether you believe in them or not, personality tests are a big hit with relationship experts, teambuilders, and even employers. Knowing more about yourself and those around you can help you build more meaningful connections.

The 20 Biggest Bankruptcies in United States History

Before they filed for bankruptcy, Lehman Brothers Holdings Inc. was the fourth-largest investment back in the United States. However, due to their involvement in mortgage origination, the company plummeted hard during the mortgage crisis of 2008.

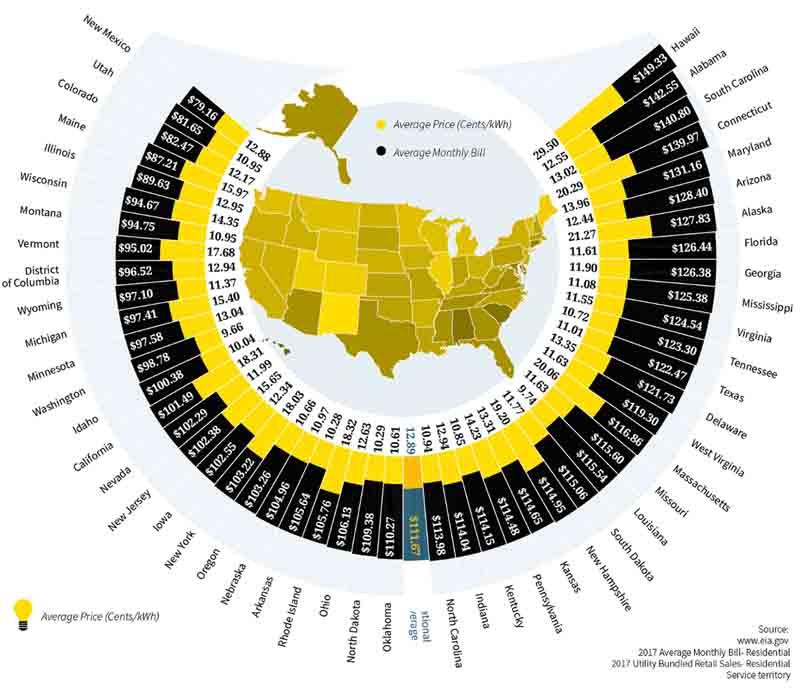

Where In the U.S. Are the Worst Electricity Bills?

If you’ve ever stopped and wondered who in the United States has the highest or lowest electric bills, then this is for you. This infographic breaks down the average monthly electric bill, as well as the price per kilowatt of electricity, for each of the 50 states. While some states you’d expect to find at the top with the most expensive electricity, others you may be surprised to find at the bottom.

History of Forex Trading

The history of foreign exchange trading (Forex) is truly fascinating, especially when you consider how it started and the changes it went through as the global economy evolved into what it is today. This infographic illustrates the milestones in the history of Forex trading.

How to Stay on Top of Your Payment Plans

Paying bills on time is important because it impacts other areas of your finances including raising your credit score and saving money by not paying interest or late fees. Maintaining a payment schedule can be easily done by taking certain actions in your daily life. In this infographic, discover everything you need to know when it comes to staying disciplined, and making your car payments on time.

Factors Revealing the Future of Accounting Firms

As the technology is evolving with time, businesses are transforming their operations as well to meet the expectation of modern customers. We are quite mindful about the fact that accounting is the most crucial sector that needs to be handled precisely. Every business completely relies on its financial information to analyze the position of the company and make right business decisions.

Best Ways to Learn About Cryptocurrency Trading

The popularity and usage of cryptocurrencies have slowly been increasing, from existing alongside fiat money in paying for goods and services to acting as trading assets. If you are a trader who wants to get into the practice of crypto trading, then you need to be aware of all the possible sources of information you can tap to make you a better trader.

Why (and How) to Invest in the U.S. Land Market

Are you ready to buy land in the United States? There are many advantages to buying sooner rather than later. For example, there is a limited supply of land that is available for purchase. This means that land costs can increase as supply is limited. In the following...

Universal Basic Income

In a 2018 poll, nearly half of Americans supported the idea of a universal basic income program. What is universal basic income and what is it supposed to do? Learn all about the history and proposed future of this conceit courtesy of this infographic.

Beyond Bitcoin: How To Make Money With Blockchain

Blockchain is considered by many to be the most important invention since the Internet with its ability to enable entirely new business models, and transform the way we live, work, entertain ourselves, and relate to one another. You don’t have to be a Bitcoin millionaire to make money from blockchain technology. Learn how to leverage this emerging technology from this infographic.

What Your Myers-Briggs Personality Type Means for Your Wallet

Personality tests are used to give us insights on how we perceive the world, how we interact with others, and how we make decisions. Whether you believe in them or not, personality tests are a big hit with relationship experts, teambuilders, and even employers. Knowing more about yourself and those around you can help you build more meaningful connections.

The 20 Biggest Bankruptcies in United States History

Before they filed for bankruptcy, Lehman Brothers Holdings Inc. was the fourth-largest investment back in the United States. However, due to their involvement in mortgage origination, the company plummeted hard during the mortgage crisis of 2008.

Where In the U.S. Are the Worst Electricity Bills?

If you’ve ever stopped and wondered who in the United States has the highest or lowest electric bills, then this is for you. This infographic breaks down the average monthly electric bill, as well as the price per kilowatt of electricity, for each of the 50 states. While some states you’d expect to find at the top with the most expensive electricity, others you may be surprised to find at the bottom.

History of Forex Trading

The history of foreign exchange trading (Forex) is truly fascinating, especially when you consider how it started and the changes it went through as the global economy evolved into what it is today. This infographic illustrates the milestones in the history of Forex trading.

How to Stay on Top of Your Payment Plans

Paying bills on time is important because it impacts other areas of your finances including raising your credit score and saving money by not paying interest or late fees. Maintaining a payment schedule can be easily done by taking certain actions in your daily life. In this infographic, discover everything you need to know when it comes to staying disciplined, and making your car payments on time.

Search 12,100+ Infographics!

Partners

Browse Archives By Category

Animated Infographics

Business Infographics

Career & Jobs Infographics

Education Infographics

Entertainment Industry Infographics

Environmental Infographics

Finance & Money Infographics

Food & Drink Infographics

Health Infographics

Historical Infographics

Home & Garden Infographics

Internet Infographics

Law and Legal Infographics

Lifestyle Infographics

Marketing Infographics

Offbeat Infographics

Parenting Infographics

Pets & Animals Infographics

Political Infographics

Shopping Infographics

Sports and Athletic Infographics

Technology Infographics

Transportation Infographics

Travel Infographics

Video Infographics