Finance & Money Infographics

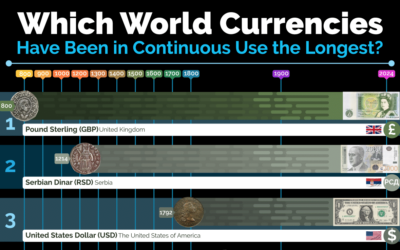

Which World Currencies Have Been in Continuous Use the Longest?

There are many coin and bill collectors out there, likely because money is such a fascinating look into a country’s history and heritage. Coins often contain symbols of historical events, figures, and cultural significance. Physical currency has a long, rich history around the world, but which currencies are still in circulation have been around the longest?

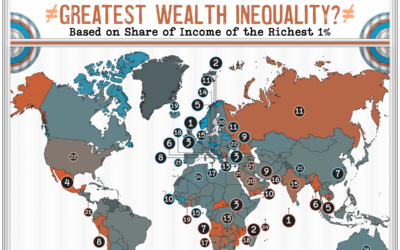

Which Countries Have the Greatest Wealth Inequality?

Income inequality can cause unrest in society and in recent years, the gap has widened in nations around the world. To find out where in the world income inequality is the most severe, look over the detailed map which calculates rankings by determining how much of the country’s total income the richest 1% share.

Popular Alternative Payment Methods Across the World

Alternative payment methods are gaining popularity due to the security of their transactions and how speedy and convenient they are. These forms of banking are accessible to people in remote areas and make it easier to do international banking. The team at Paysecure provide us a closer look at these popular banking platforms with the following infographic.

The Biggest Financial Holding Companies in the World

Financial holding companies are banks that might own other financial service companies and act as parent companies to subsidiaries. As you can imagine, companies that deal with money make a lot of it! This graphic is a fascinating look at the very top banks and financial companies in the U.S. ranked by how much money they made per second in 2023.

The Future of Payments in a Digital Age

It’s time to examine what the future of payments will look like. Cashless transactions are rising rapidly across the world, and in numerous forms. Learn more about the future of payments in the following infographic, courtesy of Minimum Deposit Casinos.

How Much Smaller a $500K House Has Become in the Past 5 Years

Real estate costs in the United States are on an unprecedented upward trajectory. Around the nation, millions of Millennials and Gen Zers are renting rather than buying as home prices are too high and real estate inventory is at an all time low. This infographic is shining a light on the issue by revealing which states have the fastest-increasing real estate prices.

British Pension Puzzlement

Eleven years after auto enrolment was introduced to the UK, employee benefits software provider Zest polled 1,003 UK adults, all currently employed, to find out how well they understood the rules around auto enrolment, and the tax and National Insurance benefits of paying into their workplace pension. This infographic summarizes the findings.

Top10 Purposes to Take Small Loans

According to a 1PLs Company (or 1Payday.Loans) study, up to 12 million Americans take out a payday loan each year. Why do people keep taking such cash advances? And most importantly, for what purpose do they take the money? This infographic compiles the top 10 main reasons why people are ready for big overpayments.

The Most Expensive Divorces of All Time

Divorces are notorious for being messy and expensive. While the average price of divorce ranges between $15,000 and $20,000 (a hefty and challenging sum for many people), this cost is a mere drop in the bucket compared to how much it costs for the rich and famous to end their marriages. This infographic showcases the 44 most expensive divorces of al time – 9 of them are over $1 billion.

Cities With the Fastest Growing and Dropping Real Estate Values

The team at RealEstateAgents.com looked at data from the National Association of Realtors to see where home prices have increased and decreased the most in the past year. The study compares median home prices of single-family homes between the fourth quarter of 2021 and the fourth quarter of 2022 to determine where in the U.S. home prices are rising and falling the most.

Which World Currencies Have Been in Continuous Use the Longest?

There are many coin and bill collectors out there, likely because money is such a fascinating look into a country’s history and heritage. Coins often contain symbols of historical events, figures, and cultural significance. Physical currency has a long, rich history around the world, but which currencies are still in circulation have been around the longest?

Which Countries Have the Greatest Wealth Inequality?

Income inequality can cause unrest in society and in recent years, the gap has widened in nations around the world. To find out where in the world income inequality is the most severe, look over the detailed map which calculates rankings by determining how much of the country’s total income the richest 1% share.

Popular Alternative Payment Methods Across the World

Alternative payment methods are gaining popularity due to the security of their transactions and how speedy and convenient they are. These forms of banking are accessible to people in remote areas and make it easier to do international banking. The team at Paysecure provide us a closer look at these popular banking platforms with the following infographic.

The Biggest Financial Holding Companies in the World

Financial holding companies are banks that might own other financial service companies and act as parent companies to subsidiaries. As you can imagine, companies that deal with money make a lot of it! This graphic is a fascinating look at the very top banks and financial companies in the U.S. ranked by how much money they made per second in 2023.

The Future of Payments in a Digital Age

It’s time to examine what the future of payments will look like. Cashless transactions are rising rapidly across the world, and in numerous forms. Learn more about the future of payments in the following infographic, courtesy of Minimum Deposit Casinos.

How Much Smaller a $500K House Has Become in the Past 5 Years

Real estate costs in the United States are on an unprecedented upward trajectory. Around the nation, millions of Millennials and Gen Zers are renting rather than buying as home prices are too high and real estate inventory is at an all time low. This infographic is shining a light on the issue by revealing which states have the fastest-increasing real estate prices.

British Pension Puzzlement

Eleven years after auto enrolment was introduced to the UK, employee benefits software provider Zest polled 1,003 UK adults, all currently employed, to find out how well they understood the rules around auto enrolment, and the tax and National Insurance benefits of paying into their workplace pension. This infographic summarizes the findings.

Top10 Purposes to Take Small Loans

According to a 1PLs Company (or 1Payday.Loans) study, up to 12 million Americans take out a payday loan each year. Why do people keep taking such cash advances? And most importantly, for what purpose do they take the money? This infographic compiles the top 10 main reasons why people are ready for big overpayments.

The Most Expensive Divorces of All Time

Divorces are notorious for being messy and expensive. While the average price of divorce ranges between $15,000 and $20,000 (a hefty and challenging sum for many people), this cost is a mere drop in the bucket compared to how much it costs for the rich and famous to end their marriages. This infographic showcases the 44 most expensive divorces of al time – 9 of them are over $1 billion.

Cities With the Fastest Growing and Dropping Real Estate Values

The team at RealEstateAgents.com looked at data from the National Association of Realtors to see where home prices have increased and decreased the most in the past year. The study compares median home prices of single-family homes between the fourth quarter of 2021 and the fourth quarter of 2022 to determine where in the U.S. home prices are rising and falling the most.

Search 12,000+ Infographics!

Partners

Browse Archives By Category

Animated Infographics

Business Infographics

Career & Jobs Infographics

Education Infographics

Entertainment Industry Infographics

Environmental Infographics

Finance & Money Infographics

Food & Drink Infographics

Health Infographics

Historical Infographics

Home & Garden Infographics

Internet Infographics

Law and Legal Infographics

Lifestyle Infographics

Marketing Infographics

Offbeat Infographics

Parenting Infographics

Pets & Animals Infographics

Political Infographics

Shopping Infographics

Sports and Athletic Infographics

Technology Infographics

Transportation Infographics

Travel Infographics

Video Infographics