For many small businesses suffering from cash flow problems, getting access to finance is like a race against time. If they aren’t able to get access to cash, it might mean they are downing their shutters.

To make sure this doesn’t happen, it’s advisable that businesses not choose traditional financing avenues that are often long winded, time consuming and complex. Instead choosing non-traditional forms of financing make better sense, and one such option is ‘accounts receivable factoring’.

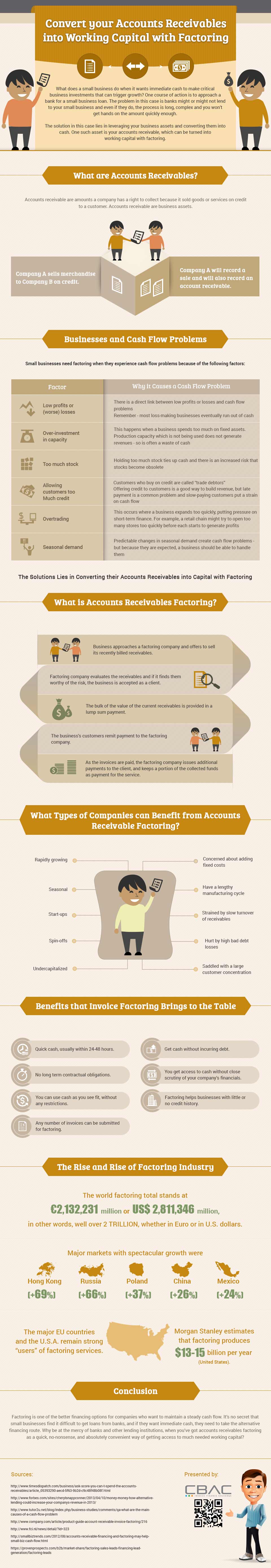

This infographic takes you through the various aspects of accounts receivable factoring to give you a better understanding of why this financing option is such a good choice for businesses.

[Click image for full size version]

Co-founder and Vice President of SearchRank, responsible for many of the day to day operations of the company. She is also founder of The Arizona Builders' Zone, a construction / home improvement portal.