As self-employed individuals, gamers/streamers can write off certain expenses that are deemed necessary for their business. But since gaming is a very specific niche, figuring out the appropriate set of deductions can be a little tricky.

However, as a streamer, you can claim a deduction for the home office on your income tax return. The IRS states that in order to claim a home office deduction, the home office area must be used regularly and exclusively as the principal place of business. To claim the deduction, you need to figure out the area your workspace consumes, and accordingly, you can deduct a portion of your mortgage interest, rent, utilities, real estate taxes, maintenance, repairs, and other related expenses.

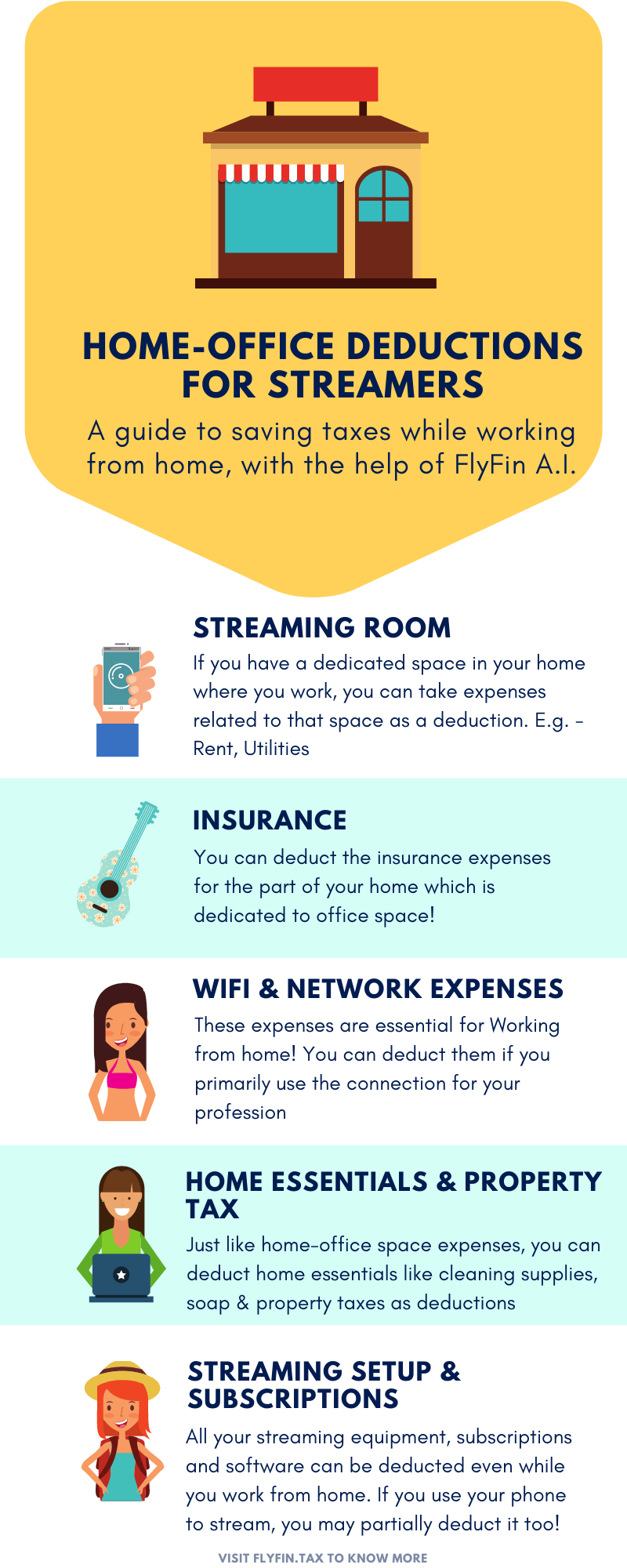

Additional details are included in the following infographic. If the calculations seem too complicated, you can use FlyFin’s home office tax calculator.

[Click image for full size version]