Monetary gain is often the motivation of criminals in infiltrating banking institutions, making the financial sector more vulnerable to fraud than other industries. Laws like the PATRIOT Act mandate financial firms to implement identity verification procedures and comply with regulations. These identity authentication processes are deployed when onboarding new clients and before authorizing transactions to ensure that the person accessing the financial services is who they say they are.

However, fraudsters are becoming more determined in circumventing security measures implemented by banks. Identity verification processes like mobile facial biometrics are seen as a viable solution to mitigate fraud. These authentication methods provide a secure and convenient way for banks to identify the legitimacy of the person transacting with them.

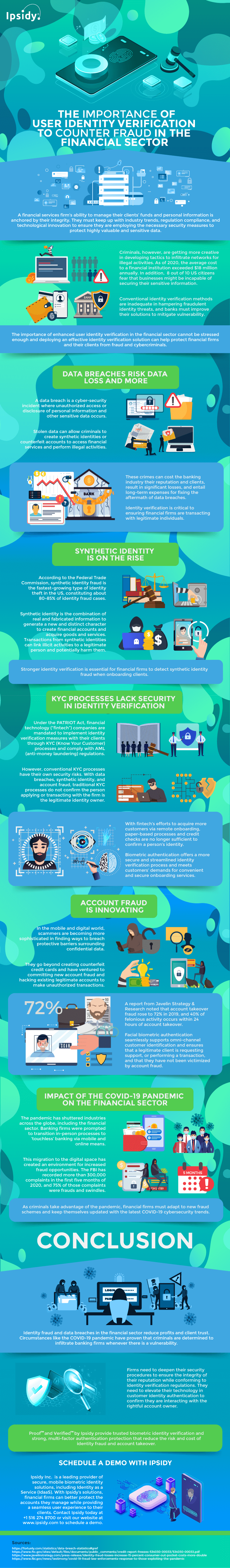

For more information on the significance of deploying trusted customer identification technology in the financial industry, here is an infographic.

[Click image for full size version]

Co-founder and Vice President of SearchRank, responsible for many of the day to day operations of the company. She is also founder of The Arizona Builders' Zone, a construction / home improvement portal.