If you’re an American citizen living abroad, you still have to pay your taxes to the U.S. government. Why is this? Because you are still subject to the same taxation rules as people living stateside.

Under the U.S. tax system, foreign income is taxed at the same rate as income earned inside the country. Therefore, you, as an American living abroad, will still need to file a U.S. federal tax return regardless of where you earned your salary or in what currency.

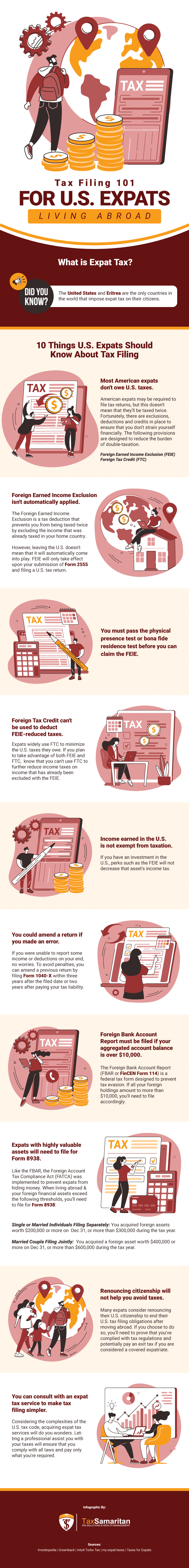

The following infographic from Tax Samaritan highlights the basics of tax filing, particularly exclusions, deductions, and credits – all of which can help reduce your taxes as an American expat. It also presents the forms and processes needed to avail of these tax reduction measures.