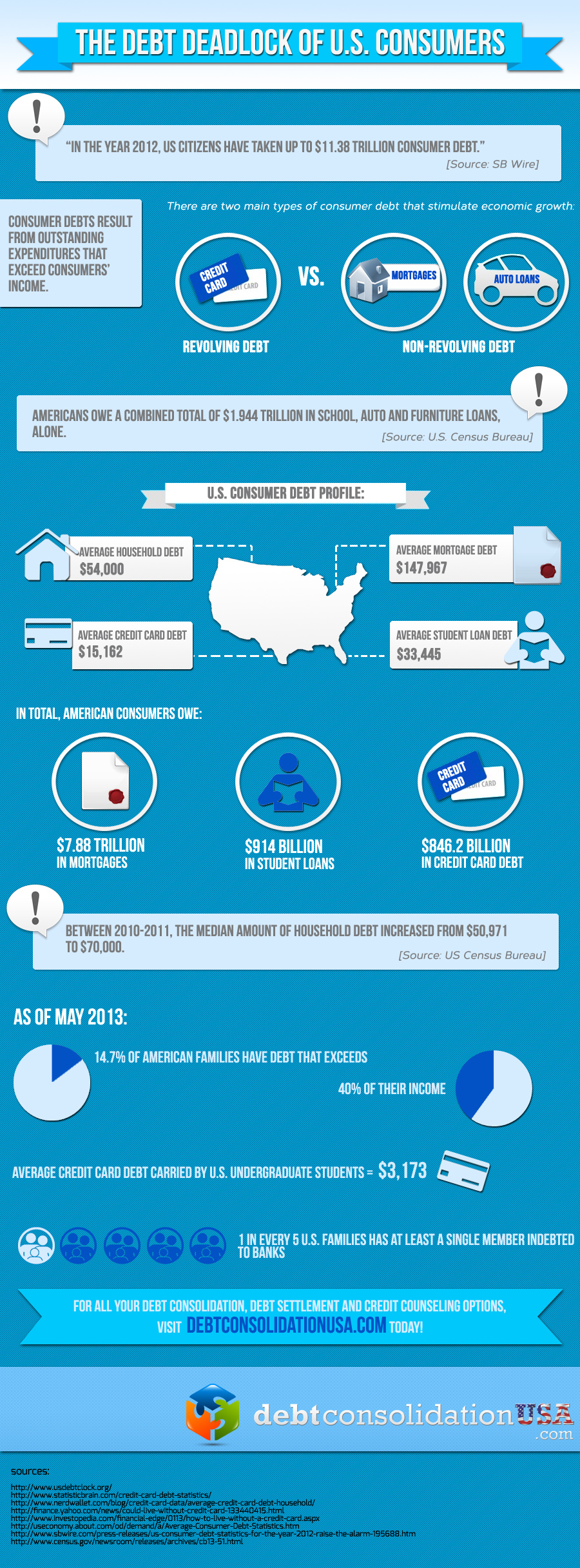

According to SB Wire, “U.S. citizens have taken up to $11.38 trillion consumer debt [in 2012].” These consumer debts result from outstanding expenditures that exceed consumers’ income.

There are two main types of consumer debt that stimulate economic growth: revolving debt (i.e., credit cards), and non-revolving debt (i.e., auto loans or mortgages). Americans owe a combined total of $1.944 trillion in school, auto and furniture loans, alone.

Learn more about this “debt deadlock of U.S. Consumers” in the following infographic.

[Click image for full size version]

Co-founder and Vice President of SearchRank, responsible for many of the day to day operations of the company. She is also founder of The Arizona Builders' Zone, a construction / home improvement portal.