In recent years, evidence-based investing has gained popularity due to its more transparent and objective nature. Investors who make decisions based on evidence can better predict how their investments will perform in the future, which can help them avoid costly mistakes. However, what exactly is evidence-based investing?

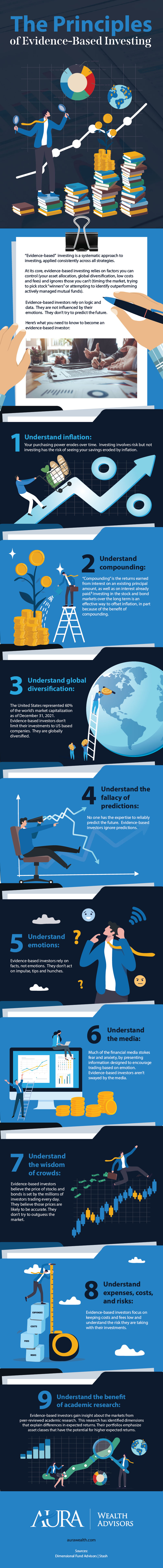

Evidence-based investing is a way of making investment decisions that rely on data to determine which stocks are worth buying. It is also called “quantitative investing” because it uses math to make predictions instead of relying on human intuition or instinct. Learn more about the principles of evidence-based investing in this infographic courtesy of Aura Wealth Advisors.

[Click here for full size version]