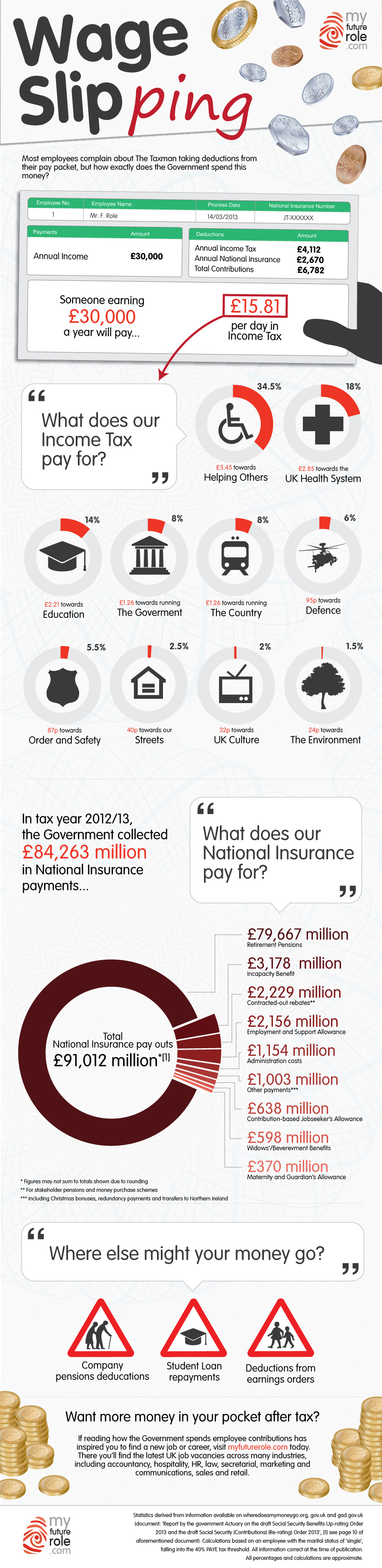

Most in the UK lose approximately one fifth (20%) of wages to Income Tax and National Insurance contributions: in tax year 2013/14 the first £9,440 of everyone’s earnings are entirely tax free. The more they earn, the more they pay: employees start paying 40% on all earnings above £32,000. For earnings above £150,000, you can expect to pay 45% (these figures for tax year 2013-14 are applicable after 6 April).

In addition, during tax year 2012/13, the UK government collected more than £91 million in National Insurance payments from the country’s workforce. But how exactly does the government spend this incredible amount of money in a way that benefits the UK, and its citizens? The following infographic aims to shed some light on this query.

[Click image for full size version]

Co-founder and Vice President of SearchRank, responsible for many of the day to day operations of the company. She is also founder of The Arizona Builders' Zone, a construction / home improvement portal.