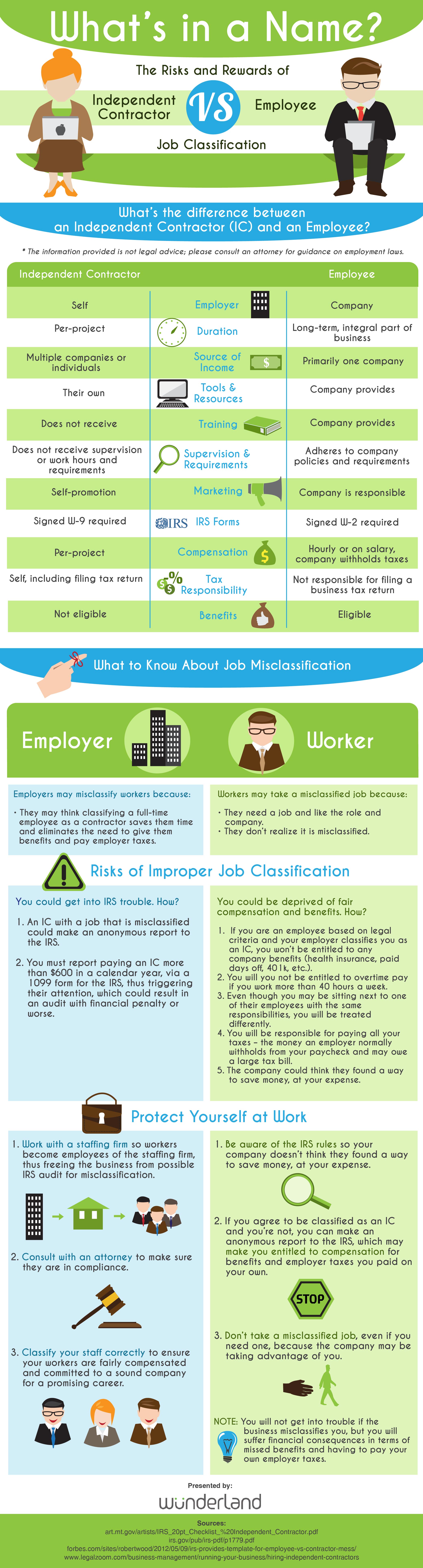

Whether you’re hiring full-time staff or freelancers, you need to know how to classify workers to the satisfaction of the IRS – or possibly pay for it later. Conversely, if you’re offered a job but the company insists on paying you as an Independent Contractor, you might be getting the short end of the employment stick.

This infographic by Wunderland highlights information that you need to know whether you’re the one hiring workers, or you’re being hired.

[Click image for full size version]

Co-founder and Vice President of SearchRank, responsible for many of the day to day operations of the company. She is also founder of The Arizona Builders' Zone, a construction / home improvement portal.